May 20, 2020

Innovation can come from any quarter. Whether it is a product or a process innovation, good ideas appear at unpredictable times and from all strata of an organization.

But innovations are like hothouse flowers. Fragile and delicate, they are often quashed before their value is realized. Too many organizations miss out on opportunities because, while they are great at top-down planning, they fail to nurture bottom-up innovation.

Organizations that get the most out of their innovations – in IT, HR, operations, or product development – have the strategic agility to leverage innovations that realize value.

But strategic agility is not achieved by an agile process alone. It requires the nurturing environment of a small executive team, backed up with a known process, and a material budget. With the right governance, process and funding, companies can create an innovation incubator that takes raw ideas and gives them their best start, allowing them in time to grow to their full potential.

A Venture Capital Model for Innovation

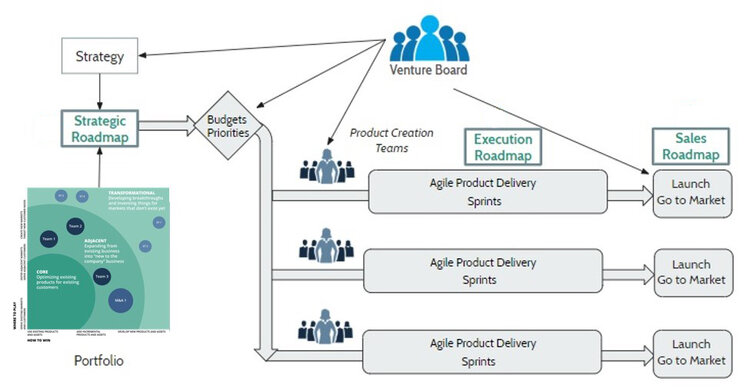

Think of the teams that develop innovations within an organization as so many start-ups, funded and monitored by venture capital. Within the company, projects compete for unallocated innovation funding, using a venture capital model, where a small number of executives continually sift through bottom-up ideas and fund the most promising.

This small executive team, or venture board, is charged with funding new ideas spontaneously and protecting them as they grow. The board incubates innovations through a transparent process, with a dedicated budget. (The context below speaks to innovative product ideas in particular. But the governance, funding and process model could also apply to other types of innovations.)

First, a company needs a governance structure that constantly selects teams pursuing new ideas and creates a protected space for innovation. Next, it needs a process for vetting new ideas to reveal their potential. Finally, it needs an Agile funding model with a substantial budget earmarked for unpredictable innovation.

- Governance: Get the right leaders to the table and give them oversight of fragile innovations. They allocate capital from the pool of venture funds, as and when needed.

- Process: Establish a process for receiving and selecting ideas; identify how to transfer ideas into development using clear entrance and exit criteria.

- Finance: Create a specific investment for the strategic innovation portfolio and approve it in the budget year. Make it large enough to start at least three projects (in round figures, about $10M per thousand employees).

Governance: The Venture Board

The venture board manages the innovation portfolio. It selects and champions innovations. Its role is to greenlight programs or segments for investment, reviewing the allocation of resources and budgeting. The venture board performs a high-level review of the budget on a regular basis, twice per year in some companies. It is also this board’s responsibility as executives to foster any cultural changes needed to support the portfolio of innovative ideas. They own this portfolio and are tasked with maintaining this perspective.

One of the most important roles of the venture board is to create a protected space that operates by different rules from the rest of the company. The internal “startups” incubated within this protected space emphasize speed, fast iterations, and freedom from bureaucracy. The venture board regulates entry and exit into and out of the protected space. Its management is either milestone-based or exception-based. In the latter approach, the board takes action only when teams begin to go awry.

The venture board continues to serve as an advocate for fragile innovation teams on an ongoing basis. Its oversight of programs is chiefly related to reviewing resource and budget allocations, as well as protecting the innovation space.

An effective venture board usually has a C-level executive in charge. This is often the CEO/GM or a Chief Product Officer or VP-Products, or another business leader with extensive new product experience and a strategic perspective.

The venture board must also equip innovative ideas to survive the rough-and-tumble political realities of the company once they leave the incubator. For projects to survive outside of the protected space it is also necessary that:

- They are funded from a budget that comes from outside of the protected space

- They have stakeholder sponsorship from outside of the venture board

- They meet criteria for maturity (for a product this might mean having a working prototype) to enable them to compete for and capture the attention and imagination of stakeholders

- The board neutralizes known threats from blockers and naysayers who might stand in the way. (We have developed a tool that helps companies identify and mitigate the effects of such political heavies, sometimes even turning them into supporters.)

The work of the venture board is crucial since many companies fail to create a container to hold fragile innovations. The portion of the portfolio that represents the core business often rejects innovations, like antibodies attacking a virus. This is why it is important to have a structure to contain and nurture innovation.

Finally, to avoid misunderstanding, it is just as important to define what a venture board is not:

- It is not a product review board: it does not review programs.

- It does not do Gate Reviews: it only invests in teams and helps them succeed.

- It is not Waterfall: teams meet to remove obstacles.

- It is not Agile: but it oversees Agile programs.

Process: A Protected Space for Early Stage Concepts

To ensure that both the teams and the venture board understand the rules, it’s important to create a transparent process. An orderly innovation process has clearly defined funding and allocation stages, as well as entrance and exit criteria for the protected space, but few rules within it.

Once companies have organized their investments, and assessed their risk tolerance, they typically look at the potential of new ideas, moving them into a discovery process and then into development. Discovery offers the protected space that shields the teams from bureaucracy so that they can assess the potential of the innovative idea. Discovery usually involves contact with customers, internal or external, and multiple Agile sprints.

Inside the protected space, projects are defined only by fit and potential at the start. Freedom and fast iteration of new ideas characterizes the middle of the discovery phase.

Use entrance and exit criteria to allow ideas to enter and leave the protected space or, if need be, to die off. Let’s look in depth at criteria for moving ideas into the incubator and development-ready projects out. Adjust these criteria to your organization and its needs.

Entrance Criteria for moving from idea/concept to discovery:

- Ideas congruent with the vision

- Large market potential

- Capable leader

- Project is staffed properly and has the right resources

- Project is free from anything that impedes fast and iterative development

Exit Criteria for moving from discovery into development:

- Confirmed market/product fit by testing prototypes with users

- Vetted the technology and removed significant realization risks

- Defined use cases and prioritized where the solution best fits

- Estimated development stage costs and created a plan for development

- Confirmed commercial potential (including profit potential)

- Ensured that the dev organization has the budget to support Go To Market

- Team has a tested leader (Product Owner or Developer)

Funding: An Agile Approach

Innovation strategy is the major responsibility of the venture board. This means ensuring strong investments in high-reward ideas, while keeping projects properly staffed, managed, and funded. The venture board manages, prioritizes, and leverages these investments.

Under this model, a company allocates funding for innovative programs but dedicates only part of the total pool to existing innovations that need ongoing funding. This leaves the rest of the pool open to fund new innovations throughout the year.

A company’s development budget is typically 2% to 20% of sales. How can a company best allocate these funds within different categories of assets in its innovation portfolio? What is the right mix of investments? How should this investment mix change, based on the risk tolerance and potential in the marketplace?

As an example, a stable company in a mature industry might allocate its product development budget as follows: 70% for development within the core business, 20% for products in adjacent markets, and 10% for transformational products. This is a relatively low-risk approach.

A tech startup, on the other hand, might allocate less than one half of its development investment to core products since the company does not have a large established market and is willing to absorb greater risk. It might have 40% invested in the core, 40% in adjacent, and 20% in transformational initiatives.

Carefully consider the relationship between risk and reward. Often companies confuse high investment with risk. There is no proof that big investment implies risk, nor that entering a new market implies reward. They may correlate, but it is often a loose correlation. Don’t fall into the trap of thinking that taking large risks or investing large sums produces high reward – it doesn’t.

Tailor the ideal investment profile to your company’s type, its maturity, its appetite for risk, and the potential value of the innovation.

How To Nurture Innovation

Innovative processes and products, those seeds of ideas that might become the next blockbuster, are of enormous value. Unfortunately, too many companies do a poor job of managing new ideas as a portfolio of assets.

But there is another way:

- Build a structure for governing early stage concepts that mirrors aspects of venture capital.

- Create a process that protects the integrity of early stage innovations.

- And invest with agility, according to an overarching vision – responding in real-time rather than following a rigid, pre-set plan.

By nurturing innovation, through this trio of governance, process and funding, organizations can build the internal structure to turn innovative ideas into blockbusters.

John Carter is a widely respected adviser to technology firms and the author of Innovate Products Faster: Graphical Tools for Accelerating Product Development. He is Founder and Principal of TCGen Inc. He has advised some of the most revered technology firms in the world including Apple, Amazon, Cisco, HP, IBM and Roche.

You have NaN out of 5 free articles to read

Please subscribe and become a member to access the entire Business Agility Library without restriction.