Good morning, everyone. I’m a local here, so I’m entitled to say welcome to Vienna! Despite, or perhaps because of, the political turmoil, we are here today to tell you a story about the beginning of an agile initiative in a somewhat unusual place—the very top of the executive ladder. This is also a story about orchestrating collaboration and business agility in the corporate banking community of Raiffeisen Bank International (RBI).

Taking Ownership: From Music to Banking

Good morning, I’m Boris, and I take full accountability for all my actions. When I worked with RBI, I also played with the Savannah Philharmonic Orchestra, so taking ownership is a very familiar concept to me. In an orchestra, every musician is responsible for their part in creating an ecstatic performance. The same applies in banking—especially in a group active in 14 different countries with over 47,000 employees. Today, we are here to share a story from our corporate optimization project and the transformation of the RBI landscape that it entailed.

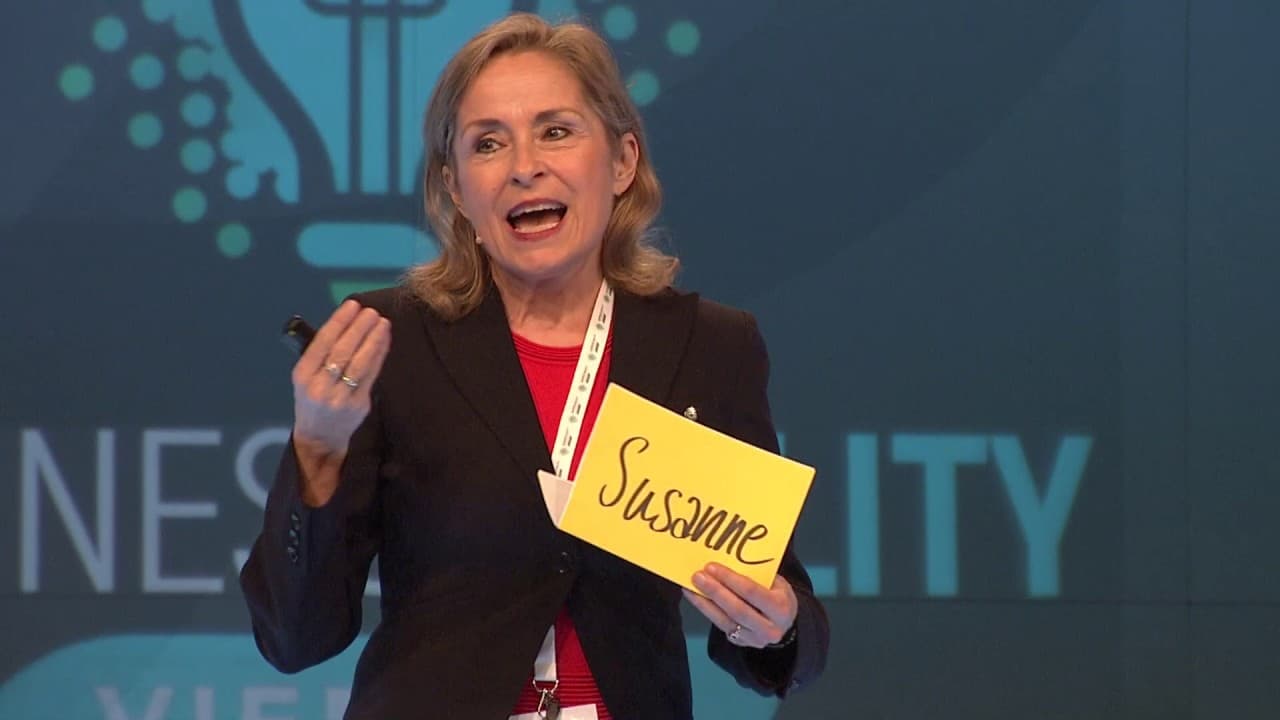

I am Boris’ external counterpart on this project, and I’ve worked with RBI for the last 20 years in different roles. At this point, I am a process coach for this project. I discovered agile about ten years ago through my husband’s work. We are both linguists, and while our shared love of language took us in different directions—him into software, me into coaching—I found inspiration in the way agile teams worked. I saw similarities between their methods and the way I worked with leadership teams and in the solution-focused community. When I saw agility spreading beyond IT into other domains, I knew I wanted to help drive this change.

Agility at the Leadership Level

At present, I work a lot with top teams. What I see frequently is that leadership tends to assign agility to others—expecting product teams, agile coaches, and middle management to "become agile" while they themselves remain unchanged. But for an organization to become truly agile, leadership teams must live and breathe agile themselves. They need to apply the methods, embody the values, and experience agility firsthand. This was a core premise of our project.

The Start of the Transformation

Before we began, in 2018, the CEO of RBI announced his intention to turn the bank into an adaptive organization. With an increasing number of agile coaches joining, the corporate board member responsible for the group decided to start an initiative directly at the heart of the business—corporate banking.

Our brief, however, was not to introduce agility. Our brief was to optimize the business model at a group-wide level across 14 different countries. The board members resonated more with the business goals than with the technical aspects of agility. Frankly, they weren’t very interested in agile itself. However, one of Steven Denning’s books was on almost every RBI manager’s desk, so we anchored the initiative in the business value it could bring.

Setting the Business Goals

We defined our central objective: better banking for international accounts. This became the driving force for the entire initiative.

At the time, we had a situation similar to a world-class orchestra with outstanding soloists. RBI had brilliant local performers in 14 countries, but they needed to collaborate more effectively to seize larger business opportunities. The challenges we faced were:

- Maintaining entrepreneurship and customization in our DNA.

- Leveraging larger business opportunities through cooperation.

- Ensuring customer focus while gaining momentum in execution.

Bringing the Leadership Together

Traditionally, RBI’s corporate board members came to Vienna once a year for two days of budget-based presentations. They reviewed figures, received instructions, and then returned to their countries to execute as they saw fit. Our goal was to change that.

We invited them twice, in April and May, and designed highly interactive sessions. We focused on four key questions:

- What should we keep as is? (Identifying core strengths and resources.)

- What should we change? (Defining targeted outcomes and priorities.)

- What can we share? (Creating opportunities for mutual learning across countries.)

- How do we want to contribute? (Structuring an effective collaborative process.)

From these discussions, four key workstreams emerged:

- Sales & Service Model

- Group-Wide Cooperation

- Process Optimization

- Digitalization & Big Data

Operationalizing the Change

Between board meetings, a core team—including Boris, a head office manager, and a representative from one of the network units—shaped the process. We established bi-weekly sprints, monthly calls with the corporate board, and clear targets for each workstream.

On May 24, 2018, the corporate board officially launched the initiative, engaging all 14 corporate board members in a transformation effort with zero cash out.

Accelerating Change with Agile Concepts

In October and November, we held further board meetings. This time, we explicitly introduced agile concepts. We formed "speedboat teams" to test hypotheses, create Minimum Viable Products (MVPs), and run market experiments. We also brought in the head of the agile coaches to explain agile ways of working and the role of MVPs.

To foster engagement, we conducted an agile survey among board members, helping them understand their current stance while gradually introducing new concepts. The result? Speedboat teams began testing prototypes with real customers and internal stakeholders.

Achievements So Far

The initiative has fully mobilized RBI’s corporate community, creating a more harmonized approach while maintaining strong local execution. Key outcomes include:

- A harmonized sales and service model.

- Improved cooperation across 14 countries.

- Higher process efficiency for selected group-wide processes.

- Progress towards digitization using Big Data.

Lessons Learned

1. Balance Control with Agility: RBI has a strong culture of achieving excellence through control. While this isn’t naturally compatible with agile, we found that by applying agile tools and processes within this framework, significant progress could be made.

2. Leverage Existing Business Agility: Instead of imposing new methods, we built upon existing agile-like practices in the organization. This allowed us to make progress faster and with greater buy-in.

3. Use Language That Resonates: We carefully framed agile concepts in business-friendly language. Using metaphors like the orchestra and speedboats helped leaders understand the changes in a relatable way.

Final Thoughts

For me, there are two key takeaways:

- If you want to quantify one thing, measure the time lost in deciding whether to start.

- Innovation requires a blend of deep skills, experience, communication, relationship-building, and emotional self-management.

In February 2019, our CEO announced RBI’s new vision: to become the most recommended financial services group by 2025. We aim to achieve this by transforming continuous innovation into superior customer experience.

The Vienna Philharmonic Orchestra is the most recommended orchestra in the world. Our corporate community orchestra has learned to play in harmony, taking the first steps towards becoming the most recommended financial services group. However, the journey is far from over.

We have another corporate meeting next week, a management off-site with the new leadership team, and more initiatives on the horizon. Wish us luck, and thank you for your time!